√ダウンロード goal-based investing pdf 327656-Goal based investing pdf

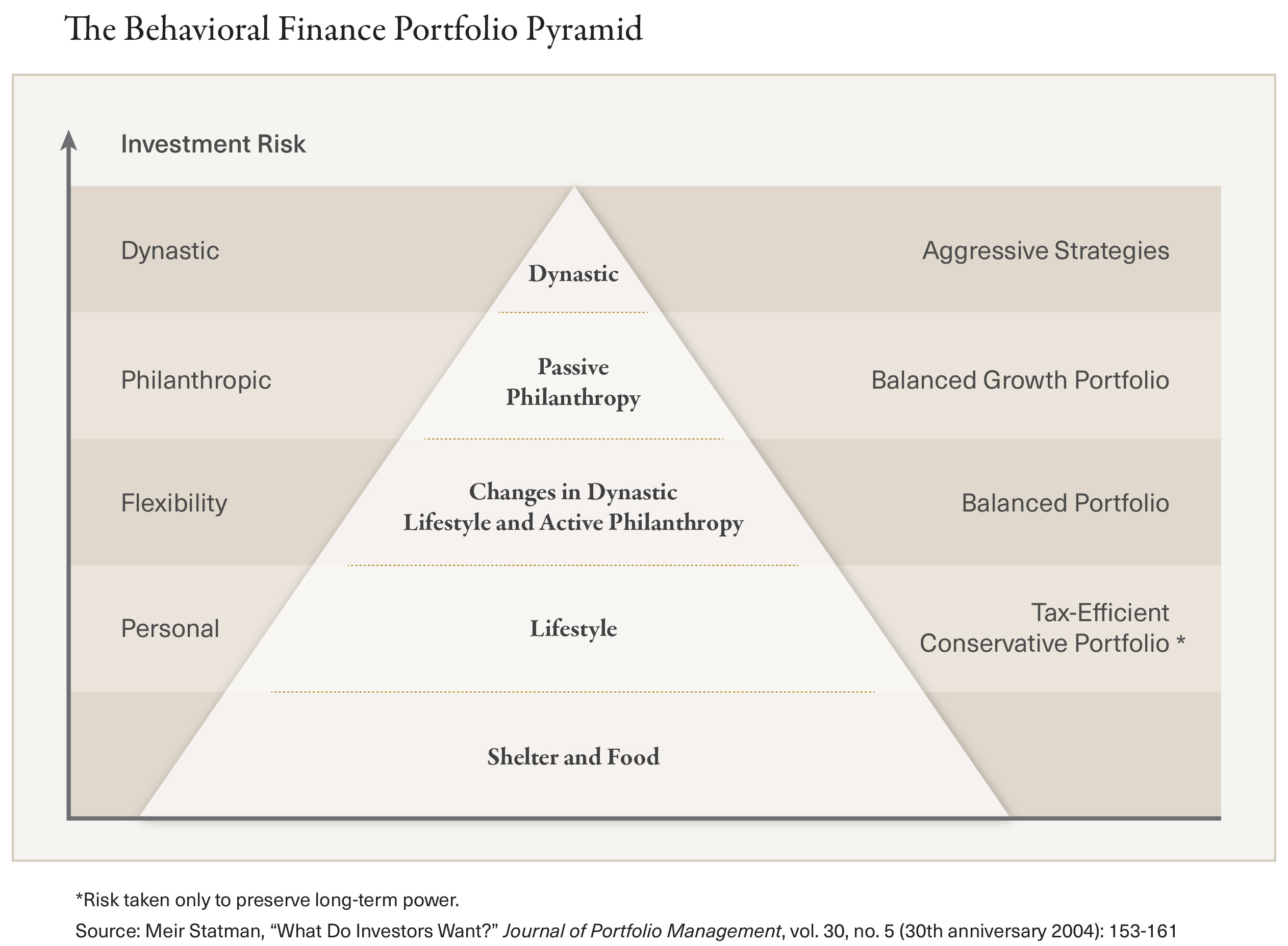

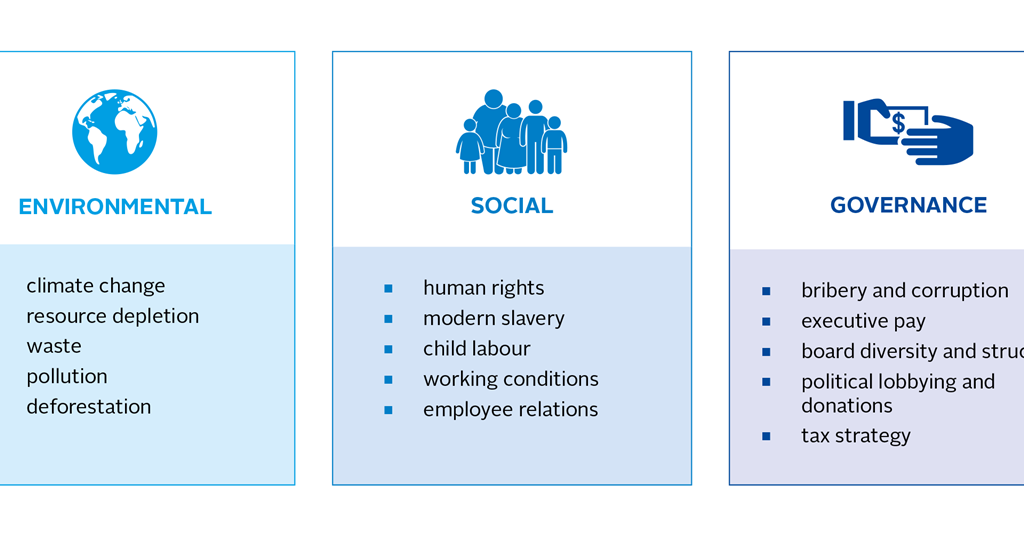

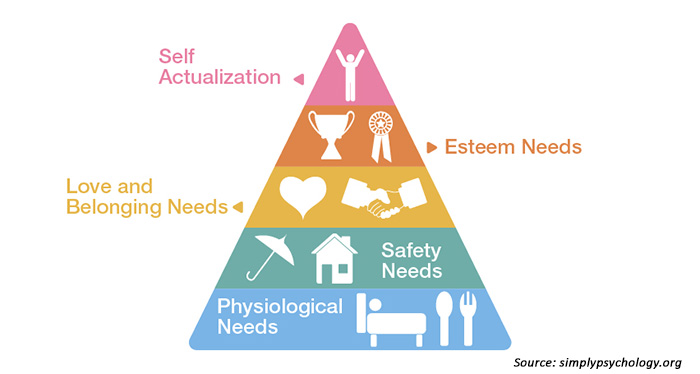

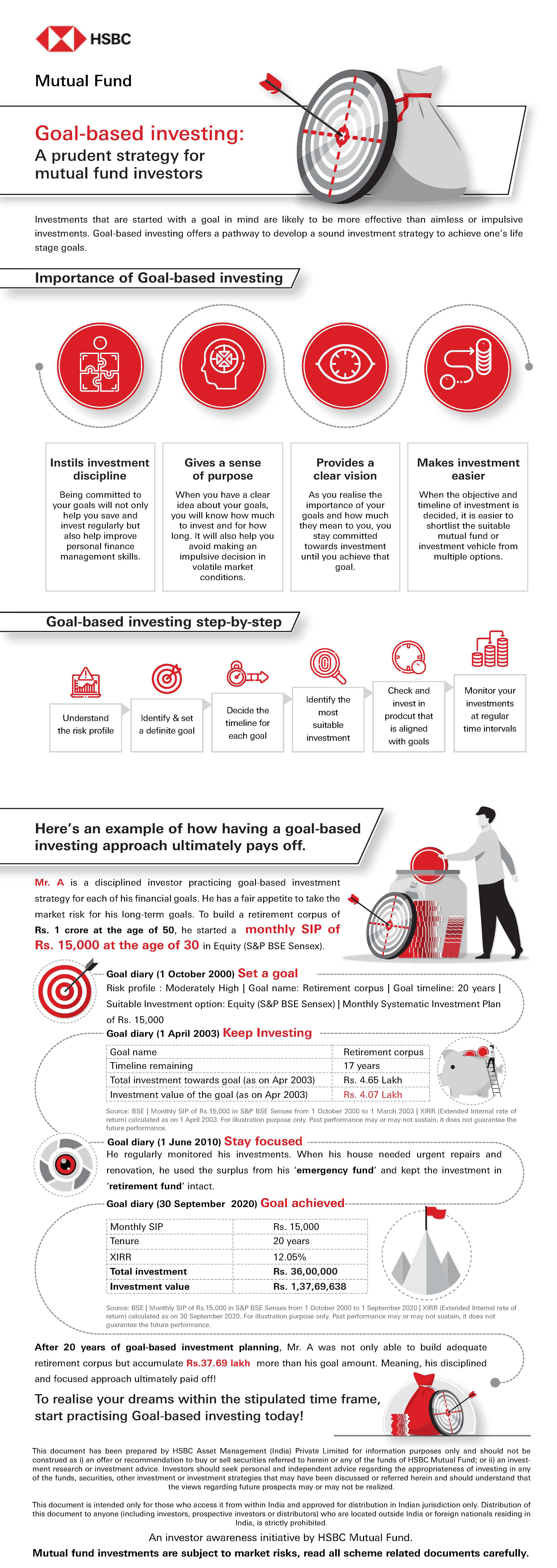

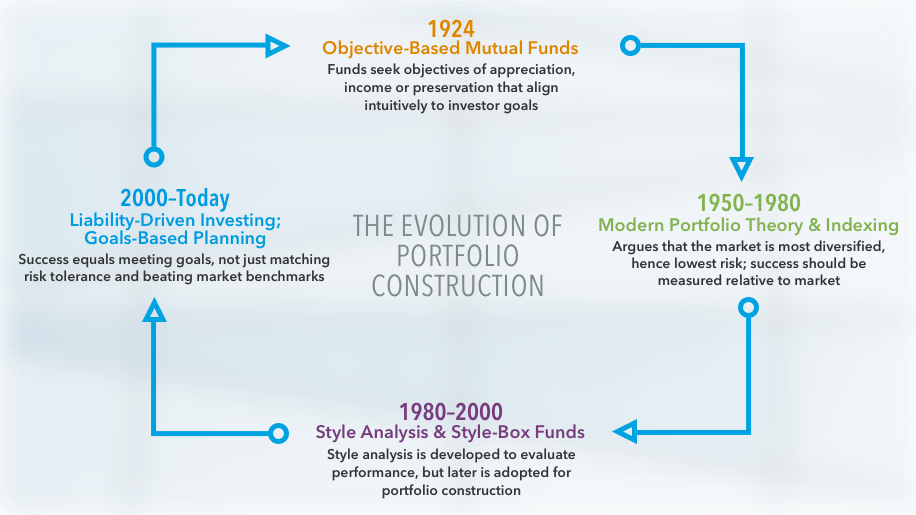

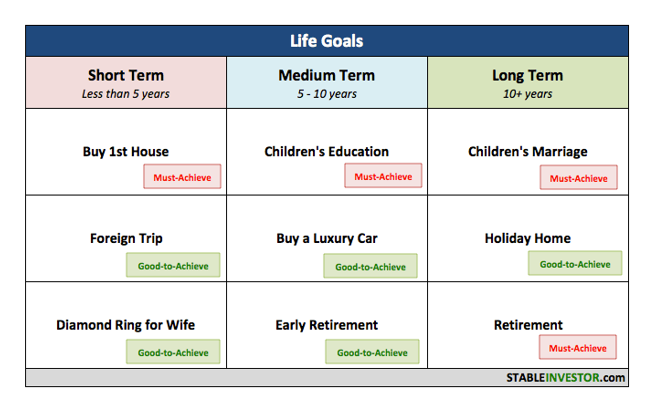

Goalsbased investing can help manage behavioral biases Goalsbased investing avoids setting personal investment strategies on the basis of indexes Indexes should be used to understand the current economic and investment environment and measure and evaluate the perform ance of strategies adopted to achieve several separate goalsGoalsBased Investing—Aligning Life and Wealth 2 GoalsBased Investing—Aligning Life and Wealth Goalsbased investing offers a powerful tool to help steel clients against market fear and uncertainty by better managing human preferences, biases and behaviours that can undermine their financial successGoalsbased portfolio to a portfolio on the mean– variance Efficient Frontier This mathematical reconcilement showed that GBWM is supported by MVT, which also forms part of the basis for the model described in this paper There is a growing practitioner literature on goalsbased wealth management Nevins (04) extended the mental

Unified Wealth Platform Fact Sheet Brochure Fiserv

Goal based investing pdf

Goal based investing pdf-19/5/17 Annuity returns based on yield from US Treasury Inflation Protected Securities (TIPS) Data provided by Bloomberg Wrong RiskFree Asset Retirement Funding Has an Income Goal But Traditional DC Investing Focuses on Wealth Accumulation Riskfree asset inflationprotected deferred annuity with payouts equal to targeted income for retirementGoalsbased wealth management (GBWM) models, see Chhabra (05), Brunel (15), and Das et al (18) In GBWM, we seek to maximize the probability that an investor's portfolio value W will achieve a desired level of wealth H—that is, W(T) ≥ H at the horizon T for the goal Starting from time t = 0, with wealth W(0), every year, we will

Goals Based Investing An Approach That Puts Investors First

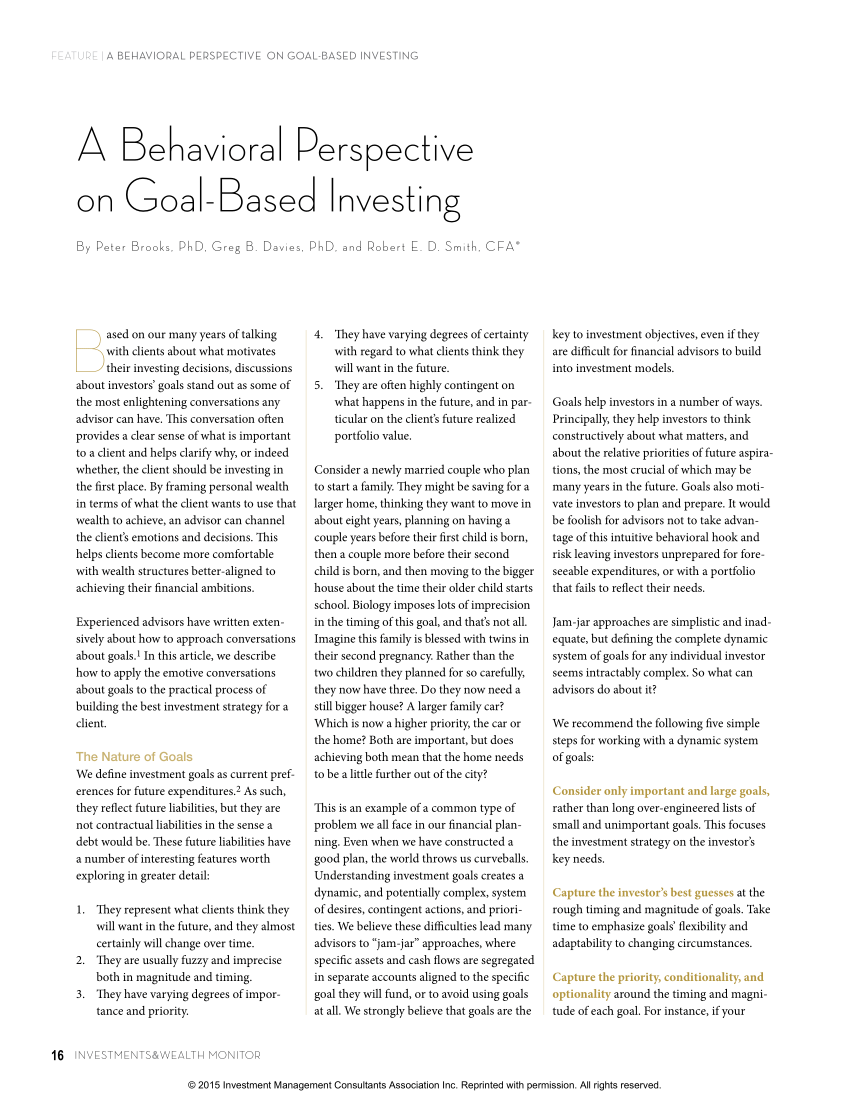

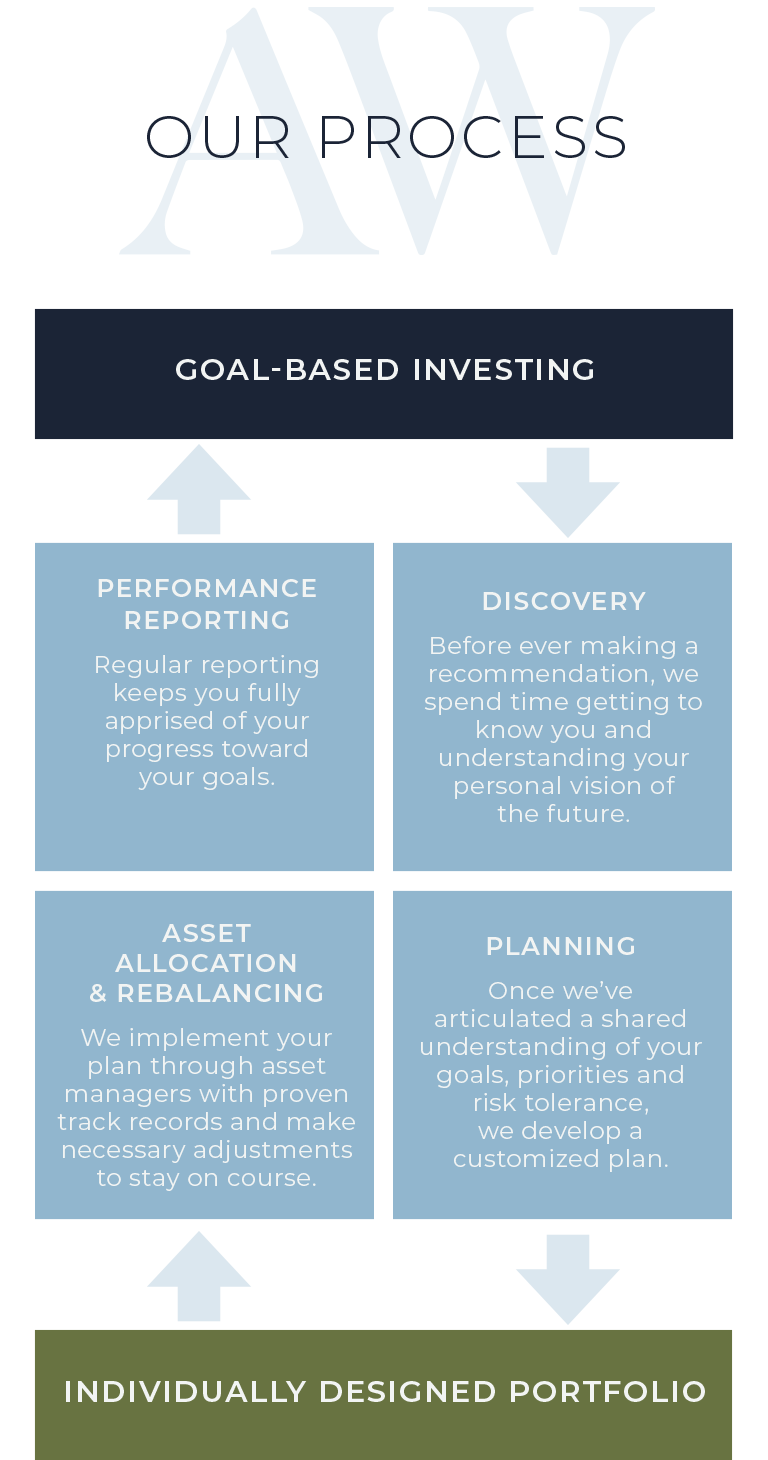

26/9/16 PART THREE Goal Based Investing is the Spirit of the Industry CHAPTER 6 The Principles of Goal Based Investing Personalize the Investment Experience 85 61 Introduction 85 62 Foundations of Goal Based Investing 63 About personal needs, goals, and risks 91 64 Goal Based Investing process 96 65 What changes in portfolio modelling 9731/1/04 1 Daniel Nevins 1 Managing director of Investment Strategy Research at SEI Investments in Oaks, PA (dnevins{at}seiccom) This article examines opportunities to improve wealth management by combining traditional finance theory with the observations of behavioral finance Areas of focus include risk measurement, risk profiling, and methods for managingPDF On , Greg B Davies and others published A Behavioral Perspective on GoalBased Investing Find, read and cite all the research you need on ResearchGate

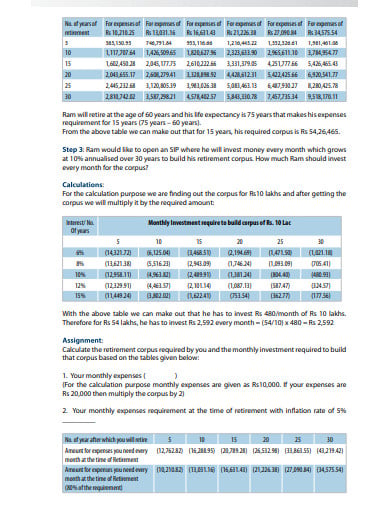

27/1/17 Goal based investing differs from traditional investing methodologies, where financial performance is defined as a return against an investment benchmark Also, instead of pooling all assets into a single portfolio, separate goalspecific investment portfolios can be created for each goalKeywords Goalsbased investing, dynamic programming, retirement planning JEL Codes G11, G40, G50 ∗We thank the editor and two referees for many constructive comments We are grateful for discussions and contributions from many of the18/3/ Goal based investing is based on the premise that financial planning is more effective when you work towards achieving a goal rather than chasing returns A goal based investment strategy first creates a personalised financial goal according to the investor's age, income, expenses, savings and risk appetite

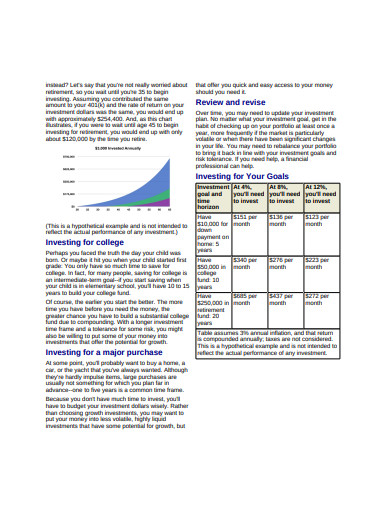

Since GoalBased Investing Indices have United States as their geographic zone, the PSP is taken to be a broad US equity index, which is weighted by capitalization because capweighted indices serve as a standard reference for the evaluation of the performance of equity strategiesLecture Note 33 GoalBased Investing 2 of such a goalbased investing framework For this, we heavily rely on the material introduced from the previous Lecture Notes with relatively little emphasis of the technical content in order to focus instead on applications An indepth description of the theory and practice of goalbased investing isStart saving early Learn how to save money first;

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Pdf Indias 1st 360 Ffpw Plan Biki Saha Academia Edu

GoalBased Asset Allocation January 14 6 of 32 have enough assets to fund all goals, and the resulting funded status determines the overall asset allocation and goalbased glidepath Defining an individual's financial goals and tradeoffs between goals30/4/ Securing Replacement Income with GoalBased Retirement Investing Strategies Lionel Martellini , Vincent Milhau , John Mulvey The Journal of Retirement Apr , 7 (4) 6;GoalsBased Investing Integrating Traditional and Behavioral Finance Daniel Nevins, CFA Journal of Wealth Management vol 6, no 4 (Spring 04)8–23 The author contends that traditional investment planning fails to recognize investors' behavioral preferences and biases,

Act Accelerator Investment Case Invest Now To Change The Course Of The Covid 19 Pandemic World Reliefweb

Goal Based Investing Process Investment Benefits Wiseradvisor Infographic

F inancial planning is a goalsbased profession Financial planners help clients determine how to accomplish their goals through advice and guidance on a variety of topics, such as saving, investing, and risk management While investing well is generally an important part of the process of accomplishing a goal, achieving a goal often requires advice beyond building appropriateGoalsBased Risk A Better Way to Understand Client's Risk Preference in the Context of Investing Well Morningstar Inc March Ryan O Murphy, PhD Head of Decision Sciences Morningstar Investment Management ryanmurphymorningstarcom Stephen Wendel, PhD Head of Behavioral Science stevewendelmorningstarcom Summary16/9/16 Introducing a Comprehensive Allocation Framework for GoalsBased Wealth Management Romain Deguest, Lionel Martellini, Vincent Milhau, Anil Suri, Hungjen Wang This publication introduces a new conceptual framework to better achieve individual investors' goals

Pdf A Behavioral Perspective On Goal Based Investing

What Is Goal Based Financial Planning Peak Financial Services

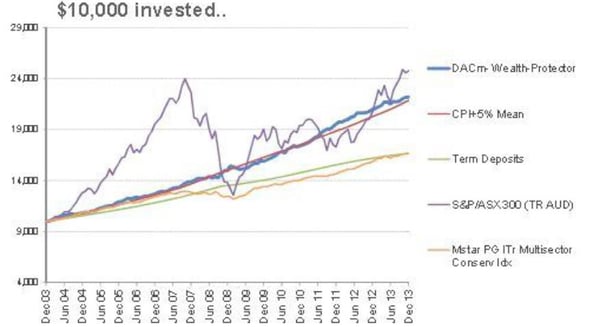

1/5/21 GoalsBased Investing With My Robo Adviser™ Goalsbased investing is a more "clientcentric" process that is focused on measuring progress towards your goals rather than a focus on generating the highest possible return or "beating the market"Advisor/SEIGoalsBasedInvestingCApdf 1) Client should be able to see clearly how investments strategies are aligned with their own goals 2) The risk exposure will be explicit to the investor, as it is expressed in terms relating to the achievement of the stated goals GoalsBased InvestingGoalsbased investing Keep an unwavering focus on the destination While MPT introduced a needed scientific discipline to the art of portfolio construction, it also had the consequence of obscuring why individuals invest The simple truth is that individuals invest to achieve important personal goals,

Why Practicing Goal Based Investing Is Essential For Small Investors

2

Goalbased investing, many investors achieve more of what matters to them and avoid a number of behavioral ine!ciencies that lower overall portfolio value, make portfolios more di!cult to manage, lower the number of goals achieved in full, and consequently, lower overall investor satisInvestment goals than a simple one Asking people t o selfreport their investing goals is insu cient About 26 percent of the participants in the study changed their top goal when prompted with reminders about other goals On a verage, using a more sophisticated ranking technique did not lead to any appreciable di erence in how investmentIn the world of investing, where honest and common sense advice is scarce, here is a book that simplifies key concepts in money management and guides you to invest with a specific goal in mind 'You can be rich –With Goal Based Investing' arms you with the relevant questions to ask

Learn More About Goal Based Investing Today Iinvest Solutions

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

Request PDF On , Romain Deguest and others published Goalbased Investing Theory and Practice Find, read and cite all the research you need on ResearchGateGoalBased Investing Index Series Highlights January 19 Highlights Over the first three quarters of 18, the general move was a rise in longterm interest rates that caused negative returns for GHPs in many months On the other hand, the PSP followed a roughly rising trend Goal based financial planning is simply a structured approach to goal based investing that can ensure a much higher chance of success in meeting your financial goals It is always recommended to engage a financial planner or advisor , if you think you need help

2

Goals Based Investing Private Wealth Partners

13/7/21 Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedgingGoalsbased investing But regardless of the approach, goalsbased investing should be built on first principles and foundational research The purpose of this article is to propose that any sound goalsbased asset allocation method should contain the following four characteristics 1 An anchor to portfolio theory 224/3/16 Last Updated on Here is a stepbystep to guide, plus calculator, to begin and track longterm goal based investing Most goal planning calculators tell you how much you should invest This sheets asks you, how much you can invest and goes about calculating the portfolio return With that you can calculate the asset allocation required (equity to fixed income

Resources Cresta Advisors Financial Planning Financial Advisor

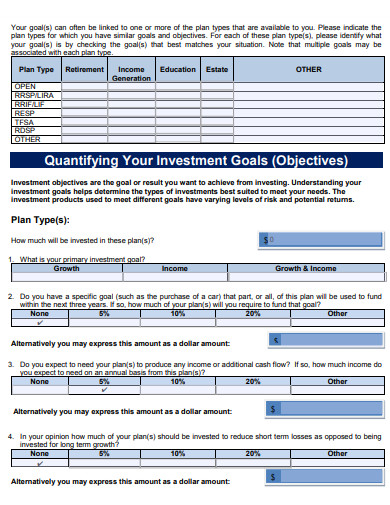

11 Investment Goals Templates In Doc Pdf Free Premium Templates

5 "GoalsBased Wealth Management in Practice", CFA Institute Conference Proceedings Quarterly, March 12, Vol 29, No 1, Jean LP Brunel, CFA 6 "GoalsBased Investing Integrating Traditional and Behavioral Finance", Daniel Nevins, Spring 04, Journal of Wealth Management SEI GOALS BASED INVESTINGindd 2 131217/8/16 PAOLO SIRONI is a global thought leader for Wealth Management and Investment Analytics at IBM, where he is responsible for promoting quantitative methods, Goal Based Investing (GBI) and digital solutions for financial advisory His expertise combines financial services and technology and spans over a number of areas, including wealth management, assetGoalsBased Investing or GoalDriven Investing (sometimes abbreviated GBI) is the use of financial markets to fund goals within a specified period of timeTraditional portfolio construction balances expected portfolio variance with return and uses a risk aversion metric to select the optimal mix of investments By contrast, GBI optimizes an investment mix to minimize the

Impact Investments Harvard Business School

Investors And The Sustainable Development Goals Thought Leadership Pri

Then learn how to invest We'll use riskfree strategies to accumulate savings in this episode, and then iGoalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assetsApplying GoalBased Investing Principles to the Retirement Problem — May 18 Abstract In most developed countries, pension systems are being threatened by rising demographic imbalances as well as lower growth in productivity With the need to supplement public and private retirement benefits via voluntary contributions,

Foundations Of Asset Management Goal Based Investing The Next Trend Pdf Free Download

How Goal Based Investing Can Help You Build Wealth Cashing To Wealth

PDF The authors propose the use of goal based investing—or private ALM, as they prefer to call it—to tailor a dynamic investment strategy to the needs Find, read and cite all theGoalsbased investing does not restrict the analysis to the same 2 variables The variables could include theoretically anything income yield, after tax total returns, probability of loss in the short term or the long term, etc Goalsbased investing can also use the same principles of1/2/16 Oct 17 Arun Muralidhar Goalsbased Investing (GBI) is slowly becoming the norm for investors Individuals save for a range of goals (eg, retirement, a

Goals Based Investing Should It Be The Norm Cfa Institute Enterprising Investor

Goals Based Investing An Approach That Puts Investors First

The Goals Driven Investing approach matches these goals with the appropriate assets and investment strategies based upon each goal's time horizon and your risk preferences, or the degree of confidence you desire for attaining each goal A FEELING OF CONFIDENCE AND SECURITY In the case of our nervous investor, his/8/18 Download free ebook of You Can Be Rich Too With Goal Based Investing soft copy pdf or read online by" P V Subramanyam","M Pattabiraman"Published on by TV18 BROADCAST LTD This Book was ranked at 28 by Google Books for keyword Personal Finance Retirement Planning prime books Book ID of You Can Be Rich Too With Goal Based Investing's BooksDoing well with money isn't necessarily about what you know It's about how you behave And behavior is hard to teach, even to really smart people Money—investing, personal finance, and business decisions—is typically taught as a mathbased field, where data and formulas tell us exactly what to do

Construction Rules Of Retirement Goal Based Investing Indices Edhec Risk Institute

Investment Strategies Definition Top 7 Types Of Investment Strategies

Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assetsGoalsbased investing empowers intermediaries, institutions and individuals alike to focus on what really matters achieving goals And when you marry those goals with our global economic perspective, it's a powerful framework that Incorporates cuttingedge insights from behavioural finance Helps keep investors focused on the right things

Factor Investing In Liability Driven And Goal Based Investment Solutions Edhec Risk Institute

11 Investment Goals Templates In Doc Pdf Free Premium Templates

1

2

Rankmf Baskets The Best Approach To Goal Based Investing

Goal Based Investing Alpha Wealth Advisors Llc

The Real Truth About Goal Based Investing Trade Brains

Fintech Innovation Pdf Fintech Robo Advisors Gamification

Goal Based Investing Theory And Practice Edhec Risk Institute

Evidence Based Investing Seeking Alpha

Introducing Flexicure Goal Based Investing Retirement Solutions Edhec Risk Institute

Foundations Of Asset Management Goal Based Investing The Next Trend Pdf Free Download

I Am Now Ready To Do Goal Based Investing What Now Arthgyaan

Download Pdf Fintech Innovation From Robo Advisors To Goal Based Investing And Gamification The Wiley Finance Series Full Books

2

Finance Technology Sironi Finance Technology Robo Advisors And Goal Based Investing Pdf Document

Unified Wealth Platform Fact Sheet Brochure Fiserv

What Is Goal Based Financial Planning Peak Financial Services

Goal Based Investing Alpha Wealth Advisors Llc

Pdf The Value Of Goals Based Financial Planning Semantic Scholar

2

1

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Why Practicing Goal Based Investing Is Essential For Small Investors

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

Steelejn71 Web App

Merrill Edge Online Investing Trading Brokerage And Advice

Foundations Of Asset Management Goal Based Investing The Next Trend Pdf Free Download

Evidence Based Investing The Evidence Based Investor The Evidence Based Investor

Goal Based Investing Mutual Funds Research App

Collective Investments Jan 15 Goals Based Investing Pdf Document

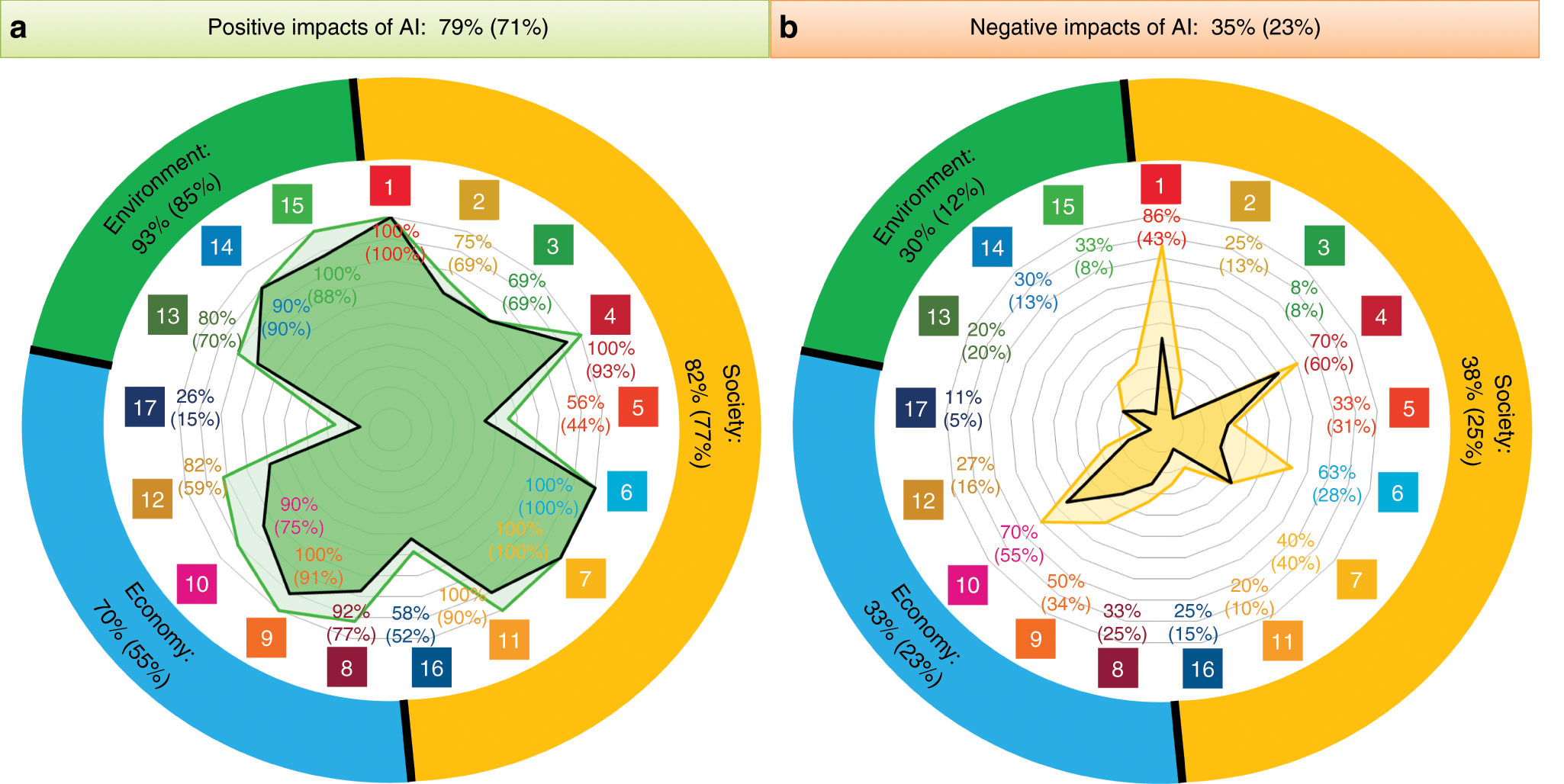

The Role Of Artificial Intelligence In Achieving The Sustainable Development Goals Nature Communications

:max_bytes(150000):strip_icc()/wealthfront-vs-td-ameritrade-essential-portfolios-072e85eb93f449cab08317a9625d8776.jpg)

Goal Based Investing Definition

The Power Of Goal Based Investing First Republic Bank

Why Practicing Goal Based Investing Is Essential For Small Investors

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Goal Based Investing How Does It Work Everyfin Newsletter

Financial Guidance Investment Advice From Merrill Edge

Goal Based Investing Ppt Powerpoint Presentation Outline Outfit Cpb Powerpoint Slide Images Ppt Design Templates Presentation Visual Aids

Pdf You Can Be Rich Too With Goal Based Investing Epub Connellraymund

What Is Responsible Investment Introductory Guide Pri

Start Investing Online Today With J P Morgan Chase Com

2

Goals Based Investing An Approach That Puts Investors First

Goal Setting Investing For Your Life Goals Icici Blog

How To Pick The Best Investment Tool For You Ally

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

Karnowski Pl

What Is Goal Based Financial Planning Anyway Stable Investor

4 Things To Keep In Mind While Investing In Mutual Funds For Retirement Product Presentation Leaflet

2

Real Success With Goals Based Investing Proactive Advisor Magazine

Goals Based Investing Suggested As Replacement To Advisers Traditional Approach Ardent Wealth

Educational Infographics

/the-little-book-of-common-sense-investing-6bd67a804c8047ff8c4c935c3197271f.jpeg)

The 9 Best Books For Young Investors In 21

Goals Based Investing For Affluent Families And Individuals Sei

Do Your Investments Match Your Financial Goals

Pin On Products

Back To The Future The Return Of Objective Based Investing Capital Group

Storage Googleapis Com

A New Vision For Great Governance

A Framework For Goals Based Investing Boston Private

What To Expect From Goals Based Investing Gbi

Plan In A Targeted Manner And Achieve Your Financial Goals Ubs Switzerland

You Can Be Rich With Goal Based Investing A Book By Subra Pattu

Goal Based Investing Is The Modern And Correct Way To Personal Wealth Management And Investing Investorpolis

What Is Goals Based Investing And How Does It Work Manulife Private Wealth

How I Save For Short Term Goals

Investment Management Integrated Wealth Management Financial Planner Investment Management Seattle

Static Twentyoverten Com

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Goals Based Investing And Why It Matters Endowus Sg

11 Investment Goals Templates In Doc Pdf Free Premium Templates

Learn More About Goal Based Investing Today Iinvest Solutions

11 Investment Goals Templates In Doc Pdf Free Premium Templates

Goal Based Investing Wikipedia

How To Set Financial Goals 6 Simple Steps

Foundations Of Asset Management Goal Based Investing The Next Trend Pdf Free Download

コメント

コメントを投稿